While recent trends like “going local” and the farm-to-table movement might be spurring interest in local agriculture, the financing needs of farms and other agricultural businesses can get a little bit complicated.

There’s good reason to pay attention to agriculture, however. Massachusetts contributes $492 million, or about 17 percent, to the $2.8 billion produced by the entire region of New England. While that’s just a sliver of the $395 billion produced nationally, it still means nearly 8,000 farms adding jobs to the Bay State’s economy and produce, dairy, seafood and other fresh foods to its pantries and dinner tables.

But financing farms and other agricultural businesses takes a special finesse not necessarily required of other types of businesses. Weather, local markets and restrictions on farm land all must be taken into account, said Cynthia Stiglitz, a vice president with Farm Credit East in Middleborough.

As an example, some farm land might have a special status under Chapter 61A, which grants the farm a lower tax rate. If you want to sell that land to someone who will not farm it, the seller has to pay rollback taxes. That can turn off a lot of traditional depository institutions, Stiglitz said, because they might see that tax status as a lien that can prime the mortgage. Unlike a bank or credit union, Farm Credit East relies on farm credit bonds to fund loans and because the organization only lends to agricultural businesses, its lenders are used to dealing with the unpredictable.

This year’s drought was a prime example of that. In response, the state announced a $1 million emergency loan fund farms and other agricultural businesses impacted by the drought. The state anticipates lending out increments up to $10,000 to be used for needs like irrigation and trucking in water from elsewhere.

“No matter what, you always need water. That’s the No. 1 item we need to be cognizant of,” Stiglitz said. Cranberry growers are especially nervous this year, as harvesting requires large amounts of water to flood the cranberry bogs, she said.

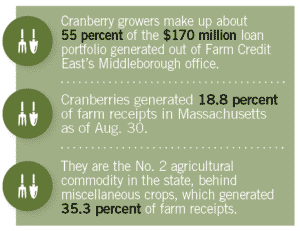

Cranberry growers also make up about 55 percent of the $170 million loan portfolio generated out of Farm Credit East’s Middleborough office. And according to data available from the U.S. Department of Agriculture, cranberries generated 18.8 percent of farm receipts in Massachusetts as of Aug. 30, making it the No. 2 agricultural commodity in the state, behind miscellaneous crops, which generated 35.3 percent of farm receipts.

Cranberry growers also make up about 55 percent of the $170 million loan portfolio generated out of Farm Credit East’s Middleborough office. And according to data available from the U.S. Department of Agriculture, cranberries generated 18.8 percent of farm receipts in Massachusetts as of Aug. 30, making it the No. 2 agricultural commodity in the state, behind miscellaneous crops, which generated 35.3 percent of farm receipts.

Besides weather, markets also matter. Stiglitz said that most farmers are “price takers,” meaning that buyers haven’t necessarily locked in a price prior to purchasing.

“It’s really intricate and you can’t go into this kind of financing without understanding the impact of these things,” Stiglitz said.

Urban Pressures, Urban Opportunities

Larry Andrews, president of the Massachusetts Growth Capital Corp. (MGCC), told Banker & Tradesman that interest in the loan fund has been low. MGCC, which administers the loan fund, recently approved its first $10,000 loan to an agricultural business out of Amherst, but Andrews expects interest to tick up as the season inches closer to harvest time.

“I know we have a client who’s looking for an extended line of credit so they’re looking for a little bump so they can get through harvest. Let’s say you have a down crop and a down price, then it’s a double whammy,” Stiglitz said. “We deal with these kinds of things all the time, so it’s case by case.”

The troubles didn’t begin with the drought, though. Warm temperatures followed by a hard freeze in the early spring devastated many farmers’ peach crops, though Stiglitz reports that apple crops are a little bit hardier.

Community development corporations, like the Quaboag Valley CDC, also play an important role in helping the state’s farmers and agriculturalists access capital and other business resources. Executive Director Sheila Cuddy said that while her organization has been directing farmers to the state’s emergency loan fund, many of them also have purchased crop insurance for just such a contingency.

“In talking with some of the farmers, they have had to adjust and plan and change knowing that the peach crop wasn’t going to be there. Then they have to try to recoup some of the revenue they would have made from that other crop,” Cuddy said.

“In talking with some of the farmers, they have had to adjust and plan and change knowing that the peach crop wasn’t going to be there. Then they have to try to recoup some of the revenue they would have made from that other crop,” Cuddy said.

But farmers are used to dealing with the vagaries of Mother Nature. Happily, Stiglitz also told Banker & Tradesman that a number of broader trends like farm-to-table, agritourism and the gravitation toward farmers’ markets have all benefitted the state’s agricultural businesses, too. She described one customer who started with a roadside farm stand and grew from there.

“As much as we have urban pressure where we are, the beauty of it is we’re right between Boston and Providence, and you have a bunch of urbanites and suburbanites who are looking for fresh, looking for local,” she said. “It’s almost there for the taking if you go about it the right way.”