Provident Bank Planning to Raise Up to $252M in Stock Offering

The parent company of Amesbury-based Provident Bank is planning to raise up to about $252 million in a new stock offering that will make the company fully public.

The parent company of Amesbury-based Provident Bank is planning to raise up to about $252 million in a new stock offering that will make the company fully public.

Ronald McLean was hired earlier this year as president and CEO of the Cooperative Credit Union Association, a trade group that represents credit unions in Massachusetts, Rhode Island, New Hampshire and Delaware.

Boston Private CEO Anthony DeChellis has unveiled an aggressive expansion plan that would see the bank triple its assets under management in its wealth management and trust division from roughly $16 billion now to about $50 billion by 2022 and grow the actual size of the bank grow from a roughly $8.4 billion in assets under management to $11.2 billion.

Amesbury-based Provident Bank is going fully public with a second-step conversion, the second by a Massachusetts bank this year following HarborOne in March.

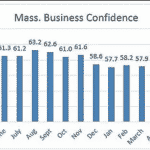

Massachusetts employers were less confident about economic conditions in May, amid renewed trade tensions and concerns among companies about increased operating costs from paid family leave and other government mandates.

Avidia Bank, a small $1.6 billion-asset bank based in Hudson, joined The Clearing House’s real-time payments system. It’s a step few, if any, community banks in the country have dared to go down and Avidia executives say it will make it a leader in the payments space.

Insured deposits at financial institutions would see a bump if Congress provided legal safety for those banking marijuana businesses.

As digital transformation continues to disrupt the banking industry, banks are forced to adjust their branch strategy in the same way as traditional retailers. But so far, all banks have really done is close branches and reduce staff.

Despite their best efforts, financial institutions have not been able to gain widespread appeal among tech talent and have had to resort to more significant incentives to draw in workers from this sought-after pool.

Hometown Financial Group and its subsidiary Pilgrim Bank have completed their merger with Abington Bank.

The town of Ashland and Needham Bank have inked a first-of-its-kind public-private venture that should help attract new businesses to Ashland’s downtown and generate new small business loans at Needham’s Ashland branch.

The parent company of Berkshire Bank has received all regulatory approvals and expects to close on its acquisition of the parent company of Willimantic, Connecticut-based Savings Institute Bank & Trust at the end of the business day tomorrow.

As the world grows more complex, financial institutions require more types of insurance for various myriad cybersecurity issues. Justin Kesner, a senior vice president of the legal professional liability division at Quincy-based Amity Insurance, is here to help.

There are many different ways to succeeding in the mortgage business, but Luisa Bedoya of MSA Mortgage has built her career on focusing on Latino homebuyers. Her strategy is beginning to pay dividends, helping her originate close to $90 million in total loan volume in 2018.

Fall River-based BankFive has received an outstanding on its most recent Community Reinvestment Act evaluation.

Two credit unions have applied to the Massachusetts Division of Banks to expand their field of memberships.

A new commissioner has been named at the Massachusetts Division of Banks amid an internal shuffle of senior management.

Several community banks in New England including Eastern Bank and Rockland Trust delivered some of the best customer satisfaction among banks in New England included in J.D. Power’s annual U.S. Retail Banking Satisfaction Study.

The banking industry has been deeply concerned over the impact CECL would have on total reserves and capital. But after first quarter earnings many New England community banks expect their reserves under CECL will be the same, if not smaller, than under the current incurred model.

Small lenders could be looking at some relief from changes to the Home Mortgage Disclosure Act that went into effect at the beginning of the year.