By working with nonprofits active in the city’s lower-income neighborhoods, Bank On Worcester County hopes to break down some residents’ mistrust of the banking system, which locks them out of economic opportunities.

One third of Bostonians live outside the traditional financial system, cutting them off from crucial financial tools like credit cards and savings accounts and helping to lock them out of economic mobility.

To combat this Boston and Worcester, where numbers are similar, are partnering with financial institutions to offer checking accounts that are easier to access.

While still in its formative stages, the goal of the Bank On program is to convince people from lower-income communities that are using no financial services or alternative services like check cashers to convert to traditional banking accounts.

“We are still learning,” said Charla Hixon, who runs the Bank On Worcester County program. “I certainly think people trusting the banks is an issue. We are often working with immigrant communities who are coming from countries where there just isn’t that strong reputation of banks and the government in their countries of origin, so it’s like learning something new once they’re here in the States.”

Life Without a Bank is Expensive

In the city of Boston, approximately 10 percent of households are unbanked, meaning they do not have a checking or savings account, while 20 percent of households are underbanked, meaning they may use alternative financial services such as check cashers, according to Boston’s Office of Financial Empowerment.

A low-income family or individual who doesn’t use safe and affordable financial products will spend about $40,000 over the course of their life on alternative financial product fees, according to Matt Wally, vice president of government and community affairs at UniBank, which participates in Worcester’s program.

A low-income family who doesn’t use safe and affordable financial products will spend about $40,000 over the course of their life on alternative financial product fees.

That’s a lot of money considering the median income in Worcester in 2017 was just over $45,000, according to the U.S. Census Bureau

But convincing people to sign up for the Bank On accounts is easier said than done.

Worcester launched the program in June 2018 and as of April had only signed up 22 accounts that they know of, according to Jenna Wills, who also runs the Bank On Worcester project.

As stated on its website, Bank On Worcester’s ultimate goal is a 10 percent increase in the number of individuals opening new accounts at partnering financial institutions.

The program would also like to see a 20 percent increase in the number of individuals receiving financial education services at the Worcester Community Action Council (WCAC) and its three partner organizations, and a 10 percent increase in the number of WCAC youth program participants who utilize banking resources.

Challenges to Gain Traction

The Boston program has also had difficulty attracting participants since launching the program two years ago, said Mimi Turchinetz, assistant deputy director of Boston’s OFE.

“It’s challenging with trust on the consumer side and there are challenges with banks,” she said. “Why does one community feel like an institution isn’t what it needs? Why would someone walk into check casher over, say, OneUnited Bank?

The disappointing results so far are certainly not for a lack of trying.

Wills said Bank On Worcester works with community partners like Worcester Free Tax Service Coalition, the Main South Community Development Corporation and Community Builders at Plumley Village East who work with lower-income residents.

Bank On Worcester asks these nonprofits to refer people to banks for Bank On accounts.

Boston is doing something similar, where the city offers free tax preparation to lower-income residents and then tries to educate people about accounts during those sessions.

Boston is doing something similar, where the city offers free tax preparation to lower-income residents and then tries to educate people about accounts during those sessions.

There is also good reason to believe that the number of accounts may not be as high as they should be, said David Rothstein, a principal at Cities for Financial Empowerment who leads the national Bank On program.

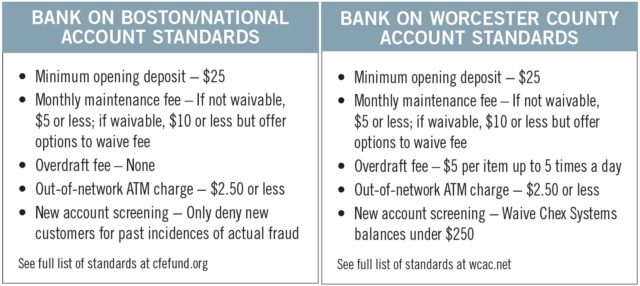

Boston’s program follows CFE standards and therefore gets funding from CFE, while Worcester is influenced by the program but uses different standards and runs it out of the WCAC.

“One of the challenges in doing Bank On account signup work is literally just trying to track it,” he said.

Currently, if a person randomly walks into a branch and signs up for a Bank On account, they would not be included in the statistics, which only track referrals.

To get better numbers, Rothstein said CFE has started a pilot program that will soon be able to parse data at the local level.

Bank On Offers CRA Boost, New Customers

While preparation is necessary to get new accounts approved by bank compliance officers, Bank On accounts also count toward a financial institution’s Community Reinvestment Act evaluations, and could be a source of new customers.

Over 70 percent of Bank On account-holders are completely new to the financial system, according to Rothstein, and have the potential to become customers that use traditional bank accounts, and maybe traditional banking products as well.

Bram Berkowitz

The program is also a good way for the different banks and credit unions to come together to address a real problem in the communities they serve.

“From an outside perspective, someone might say all these financial institutions are competitive, yet for this effort everyone around the table realizes this is a response we need,” Wally said. “By collectively putting our efforts together, we all feel we will have bigger impact of meeting underbanked and unbanked in Worcester.”

For Wally, the issue boils down to re-educating a group of people that have not grown up with and are not used to ATMs, bank tellers and branches.

“For someone who is going to a payday lender, check casher, pawn shop or putting cash under their mattress, I think a part of it is educating someone and showing them that this is a place where you can access capital,” he said. “When you want to, say, start a business of your own, this is where you need to come. We can help.”