While many financial institutions have seen success originating loans guaranteed by the U.S. Department of Veteran Affairs and Federal Housing Administration, the products face competition and challenges from rising home values and similar products created by other entities.

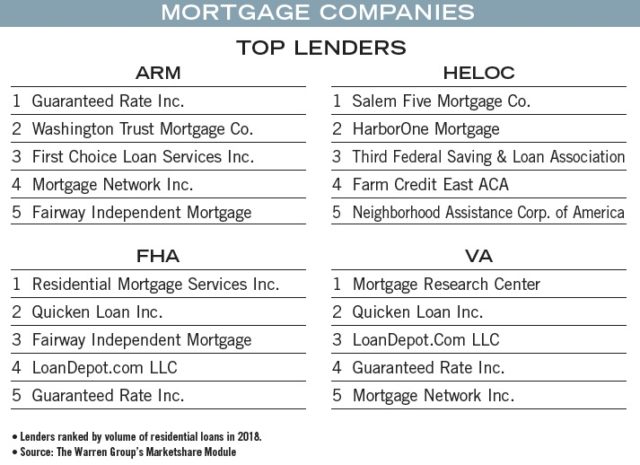

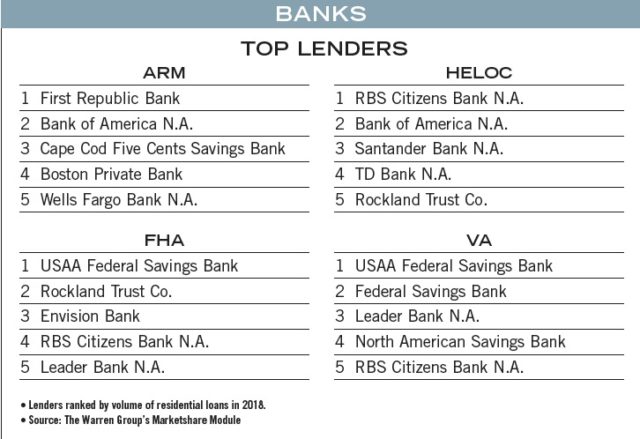

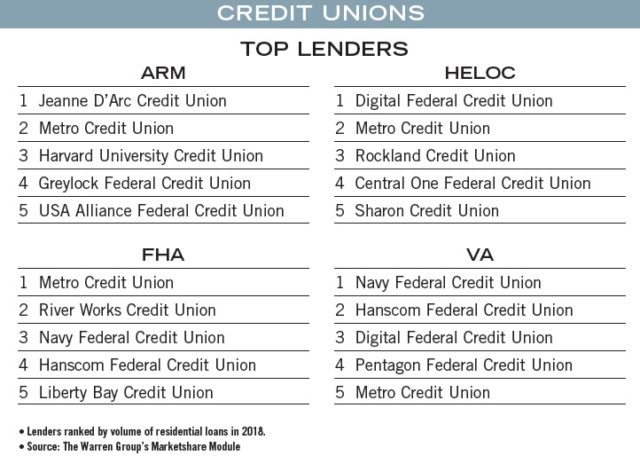

For the first time, The Warren Group is reporting the top lenders of VA and FHA loans in Massachusetts. The rankings include banks, credit unions and mortgage companies and are based on loan volume in 2018.

While they have different qualification requirements, both VA and FHA loans typically allow borrowers to put very little money down, or none at all, on a mortgage. Various government agencies then fill in the gaps so banks can originate the mortgage and still meet their underwriting standards.

They also allow borrowers with lower credit scores to qualify for loans, and may have other advantages, such as offering seller credits to help borrowers cover closing costs, which can be thousands of dollars. Although both are lenient, VA loans are considered to have the easiest qualification standards; they also require the borrower to be a veteran with a valid certificate of eligibility issued by the Department of Veterans Affairs.

Arlington-based Leader Bank was a top lender of both FHA and VA loans in 2018, an accomplishment achieved by taking a similar approach to its conventional business.

“We have attractive government loan rates. Since we are primarily a conventional loan lender, we tend to price our government loans similarly, which is significantly lower than other lenders that focus on government lending,” said Jay Tuli, executive vice president who oversees residential lending at Leader Bank. “We have a very qualified underwriting staff able to delegate both VA and FHA loans and able to turn them around relatively quick similar to conventional deals.”

But as home prices continue to rise, more loans fall outside FHA and VA loan limits, Tuli said.

Bram Berkowitz

For instance, in Dukes County, the FHA loan limit in 2019 for a single-family house is $726,525, but the median sale price in the county is $729,000.

FHA Require More Effort From Lenders

Additionally, the FHA this year introduced new underwriting standards fueled by worries over declining loan quality, which threaten to restrict access to FHA loans for riskier borrowers across the country. The FHA hopes to prevent losses to its fund, which insures mortgages guaranteed by the agency.

In order to do so, the FHA amended its automated underwriting system and now requires lenders to conduct intensive and expensive manual underwrites on any application flagged as high risk. Many smaller institutions refuse to do manual underwrites because the resulting mortgages are harder to sell on the secondary market.

Part of the reason for this change is that the FHA has lost higher-quality borrowers to competitor products from Fannie Mae and Freddie Mac.

The government-sponsored entities have developed their own low down payment programs called and Home Possible. Borrowers with a credit score of 620 or above using the HomeReady program can put little as 3 percent down, as opposed to the FHA’s 3.5 percent.

And unlike FHA loans, which have monthly fees through the life of a loan, HomeReady borrowers may have the option to cancel their monthly mortgage insurance once their home equity reaches 20 percent, which can result in lower monthly payments.

This makes the HomeReady program similar to a conventional loan in the sense that borrowers can stop paying private mortgage insurance once they achieve a loan-to-value ratio around 78 percent.

When it comes to VA loans, which offer borrowers the option to put no money down, there’s no comparable product on the market, Tuli said, protecting its status for now.