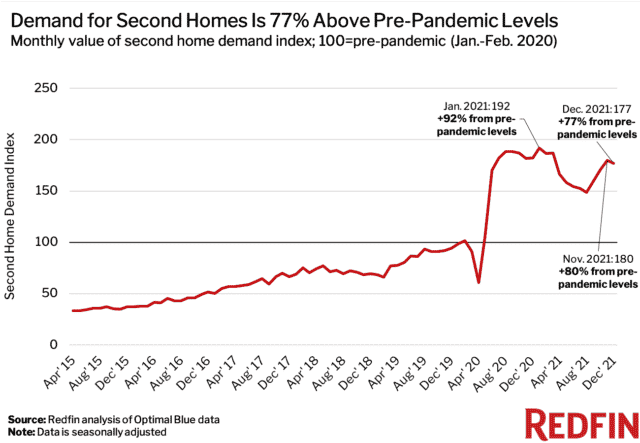

A new analysis of mortgage rate-locks by online brokerage Redfin has found that, nation-wide, demand for second homes was up 77 percent in December over 2019 levels.

Data from master-planned community home listings site Private Communities Registry suggests most aspiring buyers of second homes begin their searches in early January, suggesting that interest in real estate on Cape Cod, the islands and in the Berkshires will be strong in 2022.

Demand for second home loans in December was slightly down from demand in November, Redfin reported. November’s demand level represented a multi-month high after demand suddenly reversed in October following a long period of decline that ran from April to September.

Redfin’s analysis was based on rate-lock data provided by analytics firm Optimal Blue. A mortgage-rate lock is an agreement between a homebuyer and a lender that allows the homebuyer to lock in an interest rate on a mortgage for a certain period of time, offering protection against future interest-rate hikes. Homebuyers must specify whether they are applying to secure a mortgage rate for a primary home, a second home or an investment property. Roughly 80 percent of mortgage-rate locks result in actual home purchases.

“The wealthy are still flush with cash and have access to cheap debt, which is why second home purchases remain far above pre-pandemic levels,” said Redfin Chief Economist Daryl Fairweather. “While interest in second homes is stabilizing after the big boom in the second half of 2020 and the beginning of 2021, I expect demand to remain high well into this year. Remote work isn’t going anywhere and mortgage rates are still quite low.”

Real estate agents, particularly on Cape Cod and the Islands, have told Banker & Tradesman that elevated demand for homes there has been driven in part by a surge in office workers relocating to take advantage of flexible-work policies at their jobs. The demand has driven inventory to lows not seen elsewhere in the state, and buyers have pushed out from traditional vacation communities and into towns like Sandwich and Mashpee.

The rising demand comes as the Federal Housing Finance Agency said Wednesday that a new pricing framework will increase fees on second-home mortgages bought by Fannie Mae and Freddie Mac between 1.125 percent and 3.875 percent, tiered by loan-to-value ratio.