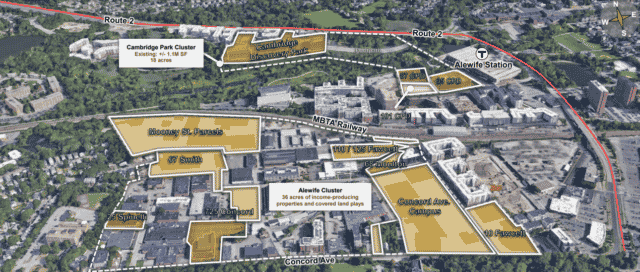

Life science developer Healthpeak Properties wants to turn the Alewife neighborhood into the centerpiece of its East Coast expansion strategy, with the goal of creating a 36-acre megacampus potentially spanning millions of square feet of lab buildings.

With more than $1.9 billion in West Cambridge acquisitions since 2019, the Denver-based REIT is poised to begin testing the city’s appetite for a second Kendall Square-like cluster.

“It’s not like we’re breaking new ground here,” Chief Investment Officer Scott Brinker remarked during a conference call discussing the company’s third-quarter earnings. “There’s a strong life science history in West Cambridge. The fact that we’re able to develop something in scale was ultimately the deciding factor here.”

A Cambridge city councilor immediately called for a moratorium on lab development in Alewife, a topic councilors will revisit this week.

But Healthpeak executives say they’re committed to West Cambridge for the long haul, with plans for a decade-plus-long buildout on parking lots, low-rise flex buildings and office buildings in the Quadrangle district off Concord Avenue.

Whose Vision for Alewife?

Healthpeak Senior Vice President Scott Bohn told councilors last week that the company is familiar with past planning studies including the Envision Alewife plan, and considers it a “guiding document” for the future of the neighborhood, including housing.

“We develop real estate for the very long term. We are not a develop-and-sell investor,” Bohn said.

Healthpeak already has put some thought into one major infrastructure project that’s been a stumbling block to other developments in the district: construction of a bridge connecting pedestrians to Cambridgepark Drive and the MBTA’s Alewife station from one of its newly-acquired parcels at 110 and 125 Fawcett St.

“[The Quad] represents a tremendous opportunity,” said Brendan Carroll, director of Boston research and Americas life sciences for Cushman & Wakefield. “There are some accessibility issues that I believe will be addressed, and at that point you have an underutilized piece of land that becomes incredibly close to the Alewife T station.”

East Cambridge has limited development opportunities and a 0.4 percent vacancy rate, according to a recent report by CBRE. Life science companies attracted to a Cambridge address can find lab space in West Cambridge for an average $93 per square foot, compared with $123 per square foot in East Cambridge, according to CBRE.

The 130-acre Quadrangle district represents the last large-scale opportunity for commercial development in Cambridge. Now developer Healthpeak Properties is hinting at the scale of its plans for a life science campus after spending $625 million in property acquisitions. Image courtesy of Healthpeak Properties

A Big-Three Lab Landlord

Founded in 1985, Healthpeak specialized in acquisitions of comparatively conservative assets such as medical office buildings and senior housing before shifting to an emphasis on the dynamic life science market. The company now ranks as the nation’s third-largest life science landlord with more than 11 million square feet under ownership, according to Newmark research, trailing only Alexandria Real Estate Equities and BioMed Realty.

Healthpeak’s $332.5 million acquisition of the newly-completed Alewife Research Center lab complex in 2019 was the harbinger of its ambitious East Coast plans, which also have included properties in Waltham and Lexington. It returned to Alewife in December 2020 to snap up the Cambridge Discovery Park campus for $720 million, where there is additional development potential.

Many life science developers seek to build clusters of properties to give tenants a wide range of options to relocate and expand, accommodating the industry’s rapid product and growth timelines. Healthpeak has not divulged how much square-footage it hopes to add in Alewife, but an investor presentation released this month says it plans a total 7 million square feet of development over the next decade in West Cambridge, south San Francisco and San Diego.

Along with lease flexibility, Healthpeak executives are touting the potential creation of a mixed-use campus in Alewife including a variety of property types and amenities for the local workforce.

“Campus settings are a competitive advantage for leasing because we can provide world-class amenities, infrastructure and flexibility for tenants to grow without relocating,” Chief Investment Officer Scott Brinker told analysts in a third-quarter earnings presentation.

Councilors Killed Prior Proposal

But permitting poses a potential roadblock, as City Councilor Patricia Nolan promptly submitted an order after Healthpeak’s latest Alewife acquisition to pause office and lab development in Alewife through the end of 2023. At a City Council meeting, residents warned that the neighborhood is at risk of being overwhelmed by traffic.

“The Quad is already surrounded by saturated traffic along Fresh Pond Parkway and Concord Avenue,” resident John Chun said. “We cannot afford to have overdevelopment happen in the Quad and we would like the process to begin so we have clear strategic planning in place for the proper development of the Quad.”

The discussion was tabled until the council’s Nov. 15 meeting.

Boston-based developer Cabot, Cabot & Forbes was frustrated in attempts to build a 1 million-square-foot mixed-use project in the Quad before ultimately selling its Mooney Street parcels to Healthpeak for $123 million in late October.

CC&F was dealt a key setback in March, when the Cambridge City Council rejected its proposed zoning overlay increasing building heights from 55 to 85 feet. CC&F had said it would construct a pedestrian bridge across the MBTA commuter rail tracks to Cambridgepark Drive in exchange for the rezoning.

Healthpeak now is mentioning another location closer to the MBTA station for a potential pedestrian bridge: a 2.5-acre property at 110 and 125 Fawcett St., which it has agreed to acquire for $45 million.

Boston-based Davis Cos. plans additional life science expansion on a nearly 10-acre site in Cambridge’s Quadrangle, including a 161,616-square-foot office-lab building at 101 Smith Place scheduled for completion in 2023. Image courtesy of The Davis Cos.

Davis Cos. Eyes More Lab Space

While Healthpeak now controls the bulk of the development sites in the Quadrangle, Boston-based Davis Cos. has unfinished business in the district at its own 9.8-acre site.

The first phase of its 10 Wilson Road and 75 Moulton St. project was fully leased in late 2020, when Boston-based Ginkgo Bioworks committed to 38,759 square feet. A 161,616-square-foot life science building at 101 Smith Place is scheduled for completion in mid-2023.

Steve Adams

The proposed next phase calls for two connected office-lab buildings totaling 250,000 square feet at 40 Smith Place with potential groundbreaking in early 2024, said Duncan Gilkey, senior vice president for The Davis Cos.

While Cambridge officials continue to discuss a potential Alewife lab moratorium, Gilkey said the firm’s parcels are further from residential neighborhoods that have generated opposition to new development.

“We’re sufficiently insulated from the residential areas, so it’s much less of an issue for us than some of the other locations,” Gilkey said, adding that the firm sees additional opportunities for acquisitions in the Quad.