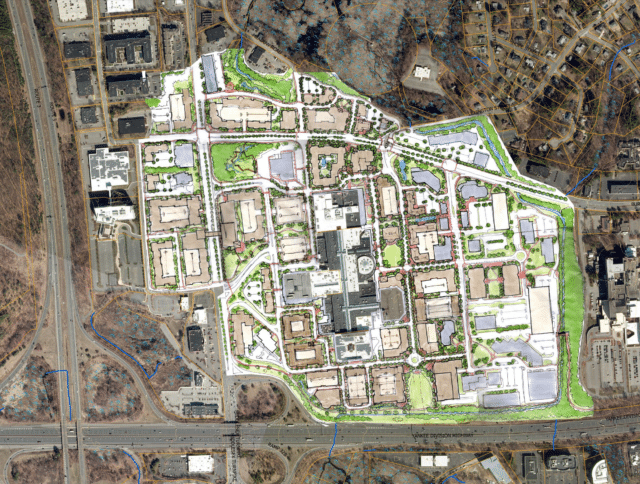

Hundreds of housing units could be added near the Burlington Mall if voters approve an overlay zoning district for 362 acres near Route 128. Photo by Steves Adams | Banker & Tradesman Staff

Question marks are swirling around the fiscal future in Burlington, a suburb with a sturdy commercial tax base resting upon its sprawling office parks and teeming shopping centers lining Route 128.

Commercial properties pay nearly two-thirds of the town’s property taxes, and Burlington’s commercial tax base has nearly doubled in the past two decades.

But office vacancies in Burlington are nearing 20 percent, and Oracle Corp. listed three of the four buildings on its Van de Graaff Drive campus for lease in late November. A planned life science conversion at the Burlington Mall’s former Lord & Taylor anchor has been delayed by the lab space glut. Other office-to-lab conversions in nearby business parks similarly have been placed on hold.

That leaves multifamily housing as a natural choice to fill the void, according to land-use planners and developers.

“Creating zoning that allows infill housing is probably the way to go, and there is a tremendous amount of demand,” said Scott Weiss, vice president of development at Burlington-based Gutierrez Cos.

Division Over Big Housing Plan

A rezoning plan for 362 acres on the north side of Route 128 could catalyze 1.2 million square feet of new development, according to Watertown-based Landwise Advisors, which was hired by town officials to study rezoning scenarios and the payoff in tax revenues.

But local officials remain divided. This month, two select board members urged the Planning Board to support the changes, but members voted 4-3 against the Mixed-Use Zoning Overlay (MIX) this month.

Opponents raised concerns about additional traffic and school costs if multifamily housing is built in the commercial district.

“We’re talking about an area that’s got a phenomenal amount of traffic and we’re going to add 1.2 million square feet,” Planning Board member Joseph Impemba said before casting a negative note at a recent meeting. “We’re looking at what appears to be a great plan. But I don’t think we need to stay on the cutting edge. I think Burlington is considered the standard right now.”

According to the Landwise fiscal analysis, the Huntington and Tremont complexes in Nordblom’s 3rd Ave. development added 0.2 students per unit, or approximately six students in the two complexes totaling 297 apartments.

Voters will have the final word at a special town meeting Jan. 27.

Burlington officials hope that rezoning the parking lots surrounding the Burlington Mall and National Development’s The District development can generate 1.2 million square feet of new development that can help solve its office vacancy problems. Image courtesy of the town of Burlington, Dodson & Flinker and Brovitz Community Planning & Design

Big-Ticket Projects Loom on Horizon

For now, Burlington’s commercial tax base spares homeowners a larger property tax burden. The current tax rate of $8.94 per $1,000 of assessed value for residential properties ranks 43rd lowest out of 351 Massachusetts communities, according to the state Department of Revenue. Commercial landlords pay $25.81 per square foot under the split tax rate structure.

But big-ticket bills are coming due in coming years. Town meeting voters have approved a new $100 million elementary school and $46 million police station, and studies are under way on a replacement high school that could cost up to $360 million.

The Landwise report estimates that the MIX rezoning could increase the town’s annual property tax income from $46.5 million to $53 million, if all of the projected development is completed.

Over the next 10 years, developers could build 1.24 million square feet of new development under the mixed-use zoning. The bulk of the activity would be in the multifamily sector, accounting for 750,000 square feet of new construction, Landwise projects. The consultants estimate the district could support 310,000 square feet of office construction and a 150,000-square-foot hotel. Nearly half of the commercial properties could add square-footage under the new zoning, according to the report.

New zoning in Burlington could encourage additional development of multifamily housing in commercial districts. In 2023, the 167-unit LifeTime Living apartment complex opened at 20 Fourth Ave. in a partnership between Nordblom Co. and the fitness club chain. Image courtesy of LifeTime Fitness

Recent Infill Projects Offer Guidance

Real estate developers followed the path of Route 128 to Burlington in the 1960s. They paved over former farmland to build shopping centers, business parks and the 1.2 million-square-foot Burlington Mall, all of which became regional destinations for office workers and shoppers.

The initial wave of development established a broad commercial property tax base that has only expanded despite the brick-and-mortar retail industry’s struggles in recent years. In the past decade, some large office parks were updated with mixed-use projects designed to make them more attractive to tenants considering moves to downtown Boston.

Burlington-based Nordblom Co. demolished older buildings in Northwest Park to make way for its 3rd Ave. project including a Wegmans supermarket, stand-alone retail and restaurant buildings, an Archer Hotel and the Huntington and Tremont apartment complexes. Newton-based National Development refreshed its own office park on District Avenue by adding a Marriott Residence Inn and three new retail and restaurant buildings.

Unlike those projects, which were approved under zoning changes submitted by developers, the MIX zoning is the town’s chance to shape its development patterns for decades, said Melisa Tintocalis, Burlington’s economic development director.

Steve Adams

The proposed MIX district envisions a similar transformation for Mall Road. Maximum building heights are proposed at 70 feet for most commercial and multifamily uses, and 120 feet for hotels.

As of the third quarter of 2024, Burlington’s office availability rate was 19.4 percent, according to Boston-based brokerage Hunneman, including a 5.4 percent sublease component. The town’s expanding lab sector has been hit with the same downturn as most Greater Boston submarkets, with 16.4 percent vacancy and another 6.1 percent available for sublet, Hunneman reports.

“Mixed use is definitely how you activate, and how you get office workers and foot traffic,” said Mark Fallon, Hunneman’s director of research and strategy.

While some major employers have announced additional return-to-office mandates, the decisions haven’t translated into increased leasing demand.

“Burlington always had a couple of big tenants floating around [looking for office space], and you don’t see that as much anymore,” said Marci Loeber, managing principal of Boston-based Griffith Properties. “If you can accommodate the 5,000 to 15,000-square-foot tenants, it’s relatively active.”

The sense of urgency is increasing, Tintocalis said. In November, Oracle Corp. listed approximately 400,000 square feet of office space for lease on its Van de Graaff Drive campus.

“It’s the death of a thousand cuts,” Tintocalis said. “A lot of the leases are still in place, but the Oracle news is something we had seen coming. This is how you reinvent the commercial district: by allowing more residential.”