Webster Bank hopes to create a regional “banking powerhouse” with its merger with Sterling National Bank, Chairman, President and CEO John Ciulla said.

When Connecticut-based Webster Bank announced merger plans last week, it marked the fourth deal this year involving banks with a significant presence in Massachusetts.

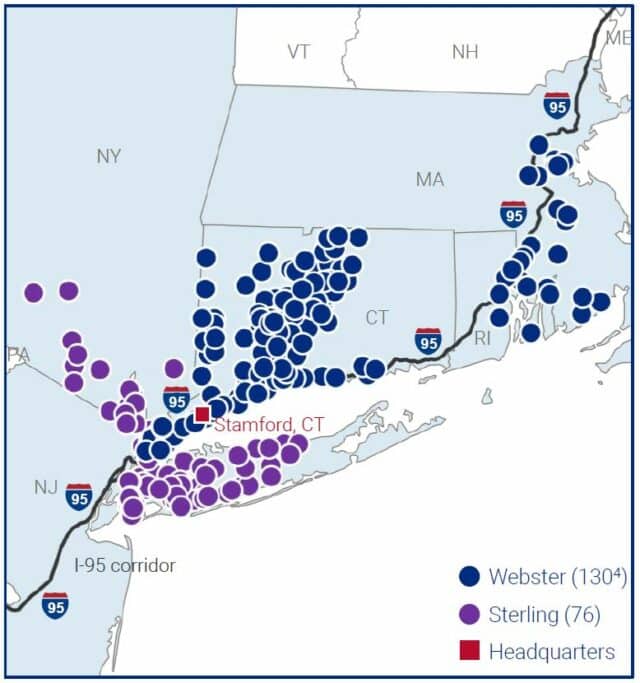

Unlike the others, the deal between Webster Bank and Sterling National Bank is a merger of equals, nearly doubling Webster’s size and expanding its mostly southern New England footprint into the New York metropolitan area and Long Island.

“[Sterling President and CEO Jack Kopnisky] and I are so excited about bringing together two great banking organizations,” Webster Bank’s Chairman, President and CEO John Ciulla said in a conference call last week to discuss the deal. “We believe that we’re creating a banking powerhouse – a differentiated, commercially–focused, high–performing franchise, with strong middle–market and retail market share from metro New York to metro Boston and established and growing national health savings and commercial banking businesses.”

Analysts say the deal makes strategic sense for Webster and could help it generate significant financial returns over time.

“From a strategic perspective, the deal will allow Webster to expand further into the Northeast, with exposure to the densely populated (but competitive) metro New York and Long Island markets,” David Chiaverini, an analyst with Wedbush Securities, wrote in a research report. “It should also help the bank to generate additional scale, an increasingly important source of profitability in the current banking environment.”

Webster Secured Good Pricing

Valued at approximately $10.3 billion, the all-stock transaction between Webster and Sterling is expected to close in the fourth quarter, subject to regulatory and shareholder approvals and other standard conditions.

The combined bank will keep the Webster Bank name, and Sterling, which had $29.9 billion in assets at the end of the first quarter, will merge into the $33.3 billion-asset Webster. Webster shareholders will own approximately 50.4 percent of the combined company, and Sterling shareholders will own about 49.6 percent.

The merger between Webster Bank and Sterling National Bank expands Webster’s footprint from Greater Boston to Long Island. Image courtesy of Webster Bank. Image courtesy of Webster Bank

Announcing the deal as a merger of equals meant Webster paid less for Sterling, said Arthur Loomis, president of Loomis & Co., a New York-based investment bank that works with banks in the Northeast on mergers and acquisitions. He said Webster is paying just a slight premium of 11 percent, while a typical acquisition would involve a 30 percent or greater premium.

With a 2-to-1 ratio of deal costs to expected cost savings, Webster would recoup the amount of the deal in two years, Loomis said, adding that was “indicative of very good pricing.”

While uncertain how Sterling shareholders will benefit from merging with Webster rather than remaining independent, Loomis said the deal was a good combination for Webster, as it will gain a significant presence in the New York metropolitan area and on Long Island. Webster currently has seven branches in New York’s Westchester County.

“I think it is a good fit in terms of the two franchises,” Loomis said. “I think that they will be additive to one another.”

Chiaverini, with Wedbush, said the scale created by the deal should help Webster grow in the Northeast region, which he said has seen both an increase in population and growing competition from other banks. He said Sterling’s largely commercial loan book, focused on commercial real estate and multifamily, is complimentary to Webster’s commercial and industrial and consumer portfolios. He said the combined portfolio would allow Webster to further diversify while also potentially generating significant cross-sell opportunities.

Another area for cross-selling is with Webster’s health savings account offered through its HSA Bank division. Chiaverini said Webster’s management expects strong demand from Sterling’s current commercial clients for the HSA product. He added that the deal could free up funds on the balance sheet to invest in HSA Bank, a potential source for future earnings, especially as health care evolves.

“Webster’s HSA Bank subsidiary is the third-largest HSA administrator in the country, and we believe the shift to consumer-directed healthcare through HSAs could ultimately be as significant as the shift from pension plans to 401k plans by corporations over the past few decades – and [Webster] is in prime position to benefit from this transition,” Chiaverini said.

Little Change to New England Branches

The deal calls for the combined bank to establish new corporate headquarters in Stamford, Connecticut, while keeping a multi-campus presence in the greater New York City area and Waterbury, Connecticut, where Webster is currently based. Sterling is based in Pearl City.

While the merger creates a $63 billion-asset bank, Webster’s Massachusetts footprint is not expected to change beyond the branch consolidation that it began over the past month.

Diane McLaughlin

Webster Bank in December had announced plans to reduce its footprint by about 17 percent by closing branches in Connecticut, Rhode Island and Massachusetts. The initiative called for the shuttering of 10 of Webster’s 29 branches in Greater Boston and Southeastern Massachusetts, and all but one of those branches have now closed.

In response to an analyst’s question during the conference call to discuss the deal, Ciulla said that the merger had no role in the decision to close branches. Ciulla said that while he and Kopnisky had talked about a deal in the past, there were no merger discussions happening when Webster decided to close branches. He added that the merger did not involve immediate plans for consolidation.

“We believe that, right now, we’re going to take the same approach that both banks do, which is to constantly look at the branch footprint, look at the customer base, look at customer behaviors and try and maximize our ability to deliver for our clients while reducing real estate expenses that aren’t necessary,” Ciulla said.