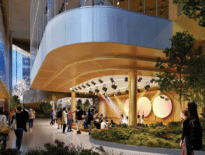

Biotechs scouting lab space in Greater Boston have a multitude of options with approximately 16 million square feet under construction at projects such as King Street Properties’ 534,000-square-foot Allston Labworks on Western Avenue. Image courtesy of DiMella Shaffer

Like our colleagues in the development community, we in biotech are proud of the fact that we are unafraid to take big swings.

The nature of our industry is one of big risks, bigger rewards, and – in our best moments – life-changing impacts for patients with unmet medical needs. It’s that sense of purpose that propels us forward in good times and steadies us in challenging times.

MassBio’s annual Industry Snapshot report, released earlier this month, found that despite some headwinds in 2022 such as a decrease in venture capital funding and a difficult macroeconomic climate, biopharma employment in Massachusetts still grew significantly in research and development and biomanufacturing, outpacing most of our competitor states.

Even with VC funding slowing slightly from the record-setting years of the pandemic, Massachusetts-based companies still received $3.7 billion in the first half of 2023, accounting for nearly one-third of all VC funding for the entire industry in the U.S.

When it comes to real estate, pandemic-era development has created an inventory that now more than meets demand. For the first time in a long while, there are metaphorical vacancy signs hanging outside lab and office spaces across the commonwealth.

Right-Sizing, not Overcommitting

This may not be the most popular thing to write, especially among the readers of this publication, but we view the increase in available lab and GMP space – Massachusetts now has nearly 62 million square feet of lab space – to be a net positive when it comes to competitiveness, job creation, and right sizing.

For current and prospective MassBio members, vacancy rates are a positive development allowing for smarter uses of capital. In the last few years, with Boston and Cambridge at full capacity, we have seen many companies overcommitting to space, impacting their bottom lines and patient-driven science. This crunch was especially felt by startups and middle-market biotech companies.

Having more available space now allows these companies more optionality and flexibility. They can occupy spaces that are most appropriate for their current needs rather than overextending themselves because of a real estate market with a zero-vacancy rate and concerns about future availability.

More available real estate has also led to growth in emerging biotech clusters outside of Boston and Cambridge. While those flagship locations will always be vital to our ability to attract and retain the best talent and most innovative companies, we’re seeing companies grow and scale in other clusters too, like Waltham, Watertown, Devens and Worcester.

This growth is already having an impact. In addition to the 2022 job data captured in our Snapshot report, we’ve already seen an additional 2,000 jobs come online in biotech R&D in the first quarter of this year, according to just published federal data, as well as a whopping 17,000 Massachusetts-based job postings since March.

Speed to Occupancy a Recruitment Tool

The availability of move-in ready facilities across the commonwealth is also a powerful recruitment tool for our economic development partners in state government.

Kendalle Burlin O’Connell

Being at full capacity has been a deterrent for national and international companies looking to locate or expand their footprint in Massachusetts. We now have a great opportunity to work with state partners to recruit large biopharma companies, offering them exactly what they need when they need it (right away) as they scale their workforce needs.

We know that supply and demand in a competitive industry is a fine balance. An extended period where supply far outweighs demand would present its own challenges for our industry and yours. But a temporary phase of more accessible and available lab, manufacturing and business space presents a prime chance for more biotech companies to grow and thrive here.

To be sure, we face real challenges when it comes to growing our leadership position in biotech, especially with issues like housing, infrastructure and transportation that won’t be solved overnight. In order to maintain our well-earned status as a global leader, we must lean on our enduring strengths like talent and diversity, as well as our newly-established inventory of purpose-built space.

We know vacancy signs can make our friends in commercial real estate uneasy. But in the biotech world, we know discomfort can sometimes lead to the best long-term outcomes, especially when the fundamentals remain sound. As we’ve said all along, we’re not afraid of taking big swings, just like you.

Kendalle Burlin O’Connell is CEO and president of MassBio.